Tax standards for energy storage projects

Clean Energy Systems Exemption

The Clean Energy Systems Exemption offered by New York State Real Property Tax Law (RPTL) Section 487 encourages the installation of certain energy systems in residential, commercial,

§48E and §45Y tech-neutral tax credits: Guide + FAQs

The tech-neutral clean energy and manufacturing tax credit regime went into effect on January 1, 2025. Learn all about §48E and §45Y tech-neutral tax credits.

Inflation Reduction Act Creates New Tax Credit

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new

Energy Storage for Communities and Local Governments

New York State aims to reach 1,500 MW of energy storage by 2025 and 6,000 MW by 2030. Energy storage is essential for creating a cleaner, more efficient, and resilient electric grid.

How to Claim the Energy Storage Tax Credit

Navigate the federal tax credit for battery storage systems. Understand the key financial considerations and procedural steps to successfully claim this incentive.

The State of Play for Energy Storage Tax Credits –

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

What are the main differences between investment tax credits and

Summary ITC: A one-time incentive for project setup, applicable to energy storage, flexible in monetization. PTC: A production-based incentive over 10 years, primarily for

What the budget bill means for energy storage tax

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an

The State of Play for Energy Storage Tax Credits – Publications

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits

What are the new tax credit opportunities for energy

These regulations provide guidance on definitions, credit calculation, metering, recapture rules, and emission rate qualifications, helping

RENEWABLE ENERGY & STORAGE PROJECTS TAX

This course is designed to give investors, developers, lenders, asset owners, utilities and their advisors an in-depth understanding of the tax issues and financial structuring issues involved

Clean Energy Tax Incentives for Businesses

Provides a tax credit for construction of new energy eficient homes Credit Amount: $2,500 for new homes meeting Energy Star standards; $5,000 for certified zeroenergy ready homes. For

Final regulations on clean electricity production and

Introduction The U.S. Treasury Department and IRS on January 7, 2025, issued final regulations (T.D. 10024) related to the section 45Y clean electricity production credit and section 48E

Navigating the Final IRS Regulations for Investment

Energy storage technology qualifies for the ITC if Section 48 requirements are met, even when co-located with facilities eligible for other tax

Energy Tax Provisions: Overview and Budgetary Cost

In the Infrastructure, Investment, and Jobs Act (P.L. 117-58), the Chips and Science Act (P.L. 117-167), and the Inflation Reduction Act of 2022 (IRA; P.L. 117-169),

What are the new tax credit opportunities for energy storage projects

These regulations provide guidance on definitions, credit calculation, metering, recapture rules, and emission rate qualifications, helping define how energy storage projects

Energy Storage in New York City

MOCEJ collaborates with public, private, and community partners to ensure New York City energy storage development meets our equity and clean energy goals and our safety standards.

What the budget bill means for energy storage tax credit eligibility

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an ITC of up to 50% under 48E if domestic

SALT and Battery: Taxes on Energy Storage

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

Strategic Guide to Deploying Energy Storage in NYC

The storage industry anticipates this to be passed into law in 2022, and that it will apply to projects that achieved commercial operation after December 31, 2020, reducing the risks and

Sections 45Y and 48E Beginning of Construction Notice

Beginning of Construction Requirements for Purposes of the Termination of Clean Electricity Production Credits and Clean Electricity Investment Credits for Applicable

Navigating the Final IRS Regulations for Investment Tax Credits:

Energy storage technology qualifies for the ITC if Section 48 requirements are met, even when co-located with facilities eligible for other tax credits. Prevailing wage and

Inflation Reduction Act Creates New Tax Credit Opportunities for Energy

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below).

Finalized Rules for Clean Energy Tax Credits: What

Read on for information on recently finalized rules for clean energy tax credits under the Inflation Reduction Act and details on eligibility,

Summary of Key Renewable Energy Provisions in the Inflation

On August 16, 2022, President Biden signed the Inflation Reduction Act of 2022 (Act) into law. The Act broadly addresses climate change, taxes, health care and inflation. In particular, the

Energy Storage Soft Costs Resources

NYSERDA Energy Storage Market Acceleration Bridge Incentives The New York State Energy Research and Development Authority''s (NYSERDA) offer incentives through its Retail Energy

Investment tax credit for energy property under section 48

Background The U.S. Treasury Department and IRS on December 4, 2024, released final regulations (T.D. 10015) relating to the investment tax credit (ITC) for energy property under

6 FAQs about [Tax standards for energy storage projects]

Does energy storage technology qualify for the ITC?

The preamble to the final regulations confirms: Energy storage technology qualifies for the ITC if Section 48 requirements are met, even when co-located with facilities eligible for other tax credits. Prevailing wage and apprenticeship requirements outlined in Sections 1.45-7, 1.45-8, and 1.45-12 apply to ITC projects.

What regulatory guidance has the government released on energy storage?

Of particular importance to the energy storage industry, the government has released final regulatory guidance for the ITC (both Section 48 and 48E of the Code), prevailing wage and apprenticeship (PWA) requirements, and transferability and direct payment, as well as other guidance on the energy community and domestic content tax credit “adders.”

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

What are the New IRA rules for energy storage?

Energy storage was one of the major beneficiaries of the IRA’s new rules on both the deployment and manufacturing sides. The IRA enacted the long-sought investment tax credit (ITC) under Section 48 and 48E of the Internal Revenue Code (the Code) for standalone energy storage facilities.

Are energy storage projects eligible for a refundable ITC?

Energy storage projects owned by taxable entities are not eligible for a refundable ITC, but instead can take advantage of the new transferability rules. The IRA added a provision to permit project owners (other than tax-exempt entities) to make an election to transfer the ITC to an unrelated third party.

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

Related information

- Which energy storage company in Bhutan exports

- Which companies are involved in New Zealand s energy storage power stations

- Swaziland environmentally friendly energy storage lithium battery manufacturer

- Solar energy storage cabinet installation

- Jordan s energy storage battery market share

- Sam inverter 20kw

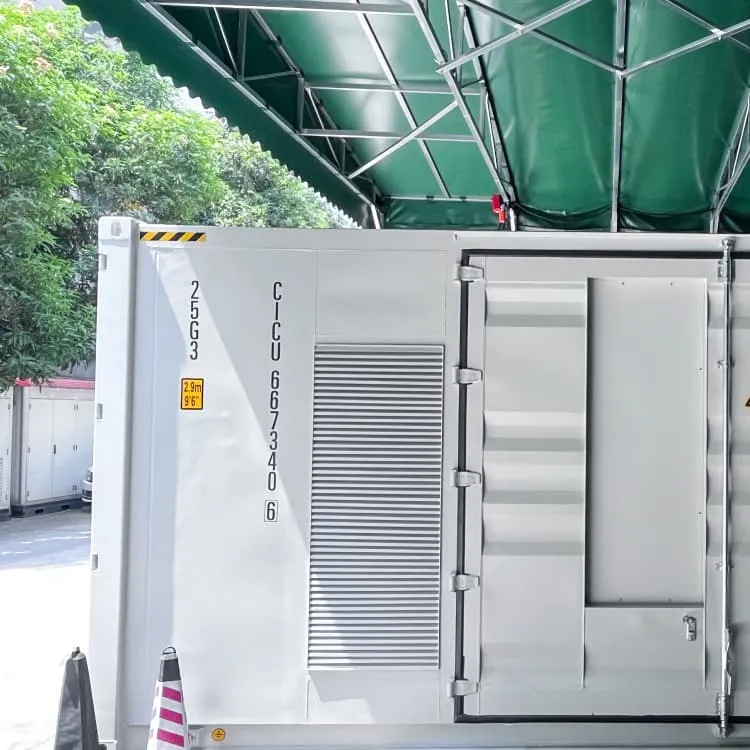

- Kiribati Energy Storage Container Sales

- Energy storage cabinet assembly and price

- Israel base station energy management system layout

- What is a grid-connected photovoltaic inverter

- How many watts does a full set of photovoltaic panels for home use require

- 40kw energy storage battery pack

- Philippines energy storage battery manufacturer

- Lithium battery station cabinet is legal

- Outdoor Energy Storage Power Supply BESS

- Bhutan outdoor communication battery cabinet custom supplier

- Flywheel energy storage needs to be imported

- Inverter mainly used for solar photovoltaic panels

- British industrial frequency off-grid inverter brand

- Containerized energy storage equipment manufacturing

- Energy storage projects in Tuvalu

- Uruguay solar rooftop power generation system

- Indoor 2000W all-in-one solar power unit