Profitability prospects of energy storage projects

2025 Renewable Energy Industry Outlook | Deloitte

Deloitte''s Renewable Energy Industry Outlook draws on insights from our 2024 power and utilities survey, along with analysis of industrial policy, tech capital,

How much is the net profit of industrial energy storage

1. The net profit of industrial energy storage is influenced by several key factors, including 1. the operational efficiency of energy storage systems, 2. market demand for energy

Energy storage project profitability analysis

The findings show that the energy storage energy self-consumption and the availability of subsidies have an impact on the profitability of a photovoltaic-integrated battery

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

How do government policies influence the profitability

Government policies significantly influence the profitability of utility-scale energy storage projects through financial incentives, market

Energy Storage in 2025: What''s Hot and What''s Next?

The energy storage landscape is changing quickly as scientists work to create better and longer-lasting storage solutions. Experts are focused on improving smart grids to

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

How much profit does energy storage project construction make?

The profit margins for energy storage projects can fluctuate considerably, as several interconnected factors such as local energy prices, installation costs, and the return on

Project Financing and Energy Storage: Risks and

Given the ever-changing landscape of energy storage technologies, some of the equipment providers and service providers are new entrants and

The new economics of energy storage

Many people see affordable storage as the missing link between intermittent renewable power, such as solar and wind, and 24/7 reliability. Utilities are intrigued by the potential for storage to

Virginia''s Largest Battery Storage Project, Prospect Power,

Swift Current Energy has officially closed US$242 million in project financing for its Prospect Power Storage facility. This marks a major milestone in the utility-scale storage

Profit Analysis in the Energy Storage Sector: Trends, Challenges,

Let''s face it – analyzing profits in the energy storage sector today is like watching a high-stakes poker game where the rules keep changing. While global installations grew 45%

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

How do different market locations impact the profitability of energy

In summary, the profitability of energy storage projects is heavily influenced by local market conditions, regulatory support, and the integration with renewable energy

Determining the profitability of energy storage over its life cycle

Levelized cost of storage (LCOS) can be a simple, intuitive, and useful metric for determining whether a new energy storage plant would be profitable over its life cycle and to

SES AI Accelerates Timeline for Revenue Growth and Profitability

SES AI Accelerates Timeline for Revenue Growth and Profitability with Acquisition of an Energy Storage System Producer UZ Energy Provided by Business Wire Jul 28, 2025,

How much profit do energy storage projects have? | NenPower

Various case studies illustrate how energy storage investments can lead to profitability, enhancing financial metrics and contributing to a sustainable energy future.

Exploration of Shared Energy Storage Business Model

Abstract. This article takes the shared energy storage business model as the discussion object. Based on the definition and classification of business models, it analyzes

Project Financing and Energy Storage: Risks and Revenue

Given the ever-changing landscape of energy storage technologies, some of the equipment providers and service providers are new entrants and may not have strong financials.

Battery storage profitability looking up in Australia,

News Release Battery storage profitability looking up in Australia, driven by power price volatility Prospects for massive US$50 billion pipeline of

Energy Report

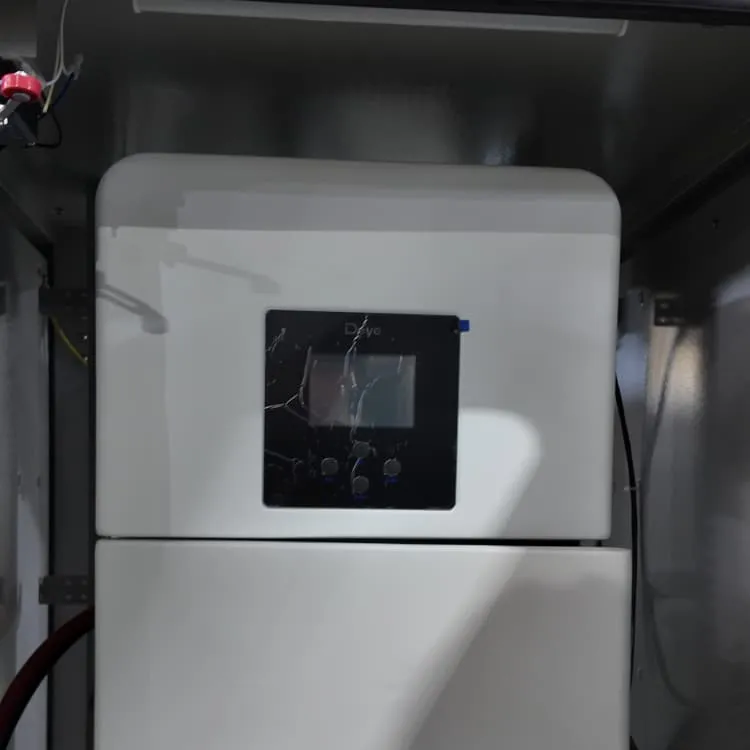

Energy Storage Systems Our commitment to delivering world-class integrated energy storage solutions to our customers is built upon employing cutting-edge renewable energy conversion

6 FAQs about [Profitability prospects of energy storage projects]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Why do energy storage projects need project financing?

The rapid growth in the energy storage market is similarly driving demand for project financing. The general principles of project finance that apply to the financing of solar and wind projects also apply to energy storage projects.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Related information

- Solar energy storage cabinet unit price

- What is the technology of energy storage cabinet battery

- How many watts of solar all-in-one machine should I buy

- Which is better a photovoltaic plant or an energy storage plant

- Large Energy Storage Vehicle Design

- Base station adjustable power supply circuit

- How much amps does a 500w inverter need for 12v

- Power-side energy storage BESS

- Burkina Faso manufacturer inverter

- Dual solar panel water pump inverter

- How big is the liquid-cooled energy storage container

- Energy storage cabinet battery retail price large battery

- Build a 5G communication engineering base station

- Microgrid and Energy Storage Systems

- China Photovoltaic Solar Energy Storage Cabinet Sales

- Can large power stations use permanent magnets to generate electricity

- Greece Smart Solar System Wholesale

- Yechu outdoor power supply

- Chad pack lithium battery factory

- Moldova individual investment energy storage power station

- Home Energy Storage Protection

- Huawei Slovakia liquid-cooled energy storage

- Grid-connected inverter power storage