Energy storage equipment tax deduction

What are the new tax credit opportunities for energy

These new tax credit opportunities under the Inflation Reduction Act substantially enhance the financial incentives for deploying energy storage

Are There Tax Credits for Whole-House Generators?

Future Trends in Home Energy Incentives The landscape of generator-related tax credits continues shifting toward cleaner technologies. Many states are revising their incentive

Final regulations clarify rules for Section 48 tax credit:

In brief What happened? The IRS and Treasury on December 12 published final regulations on the Section 48 energy investment tax credit. The regulations

The State of Play for Energy Storage Tax Credits – Publications

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits

Battery Energy Storage Tax Credits in 2024 | Alsym Energy

Homeowners can take advantage of the Residential Clean Energy Credit, which provides a tax credit for battery storage systems with a capacity of at least 3 kilowatt-hours

Cost recovery for qualified clean energy facilities, property and

Owners of qualified facilities, property and energy storage technology placed into service after December 31, 2024, may be eligible for the 5-year MACRS depreciation deduction.

Frequently asked questions about energy efficient home

Frequently asked questions about energy efficient home improvements and residential clean energy property credits - Residential Clean Energy Property Credit - Qualifying residence

Tax Credits for Energy Storage Solutions in 2025

The Residential Clean Energy Credit allows homeowners to claim a tax credit for 30% of the cost of installing renewable energy systems, including energy storage solutions like

Federal Solar Tax Credits for Businesses

Disclaimer This resource from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) provides an overview of the federal investment and production tax credits for

Select Federal Tax Credits Under the Infrastructure Investment

Note: Table excludes tax credits without direct pay options, including: Energy Efficient Commercial Buildings Deduction; New Energy Efficient Homes Credit; Residential

Battery Energy Storage Tax Credits in 2024 | Alsym

Homeowners can take advantage of the Residential Clean Energy Credit, which provides a tax credit for battery storage systems with a capacity

Clean Electricity Investment Credit

The Clean Electricity Investment Credit is a credit available under the investment tax credit businesses and other entities that invest in a qualified clean or renewable energy facility or

Energy Efficient Home Improvement Credit

IRS Announcement 2024-19 provides taxpayers with specific information on tax treatment of payments from the U.S. Department of Energy''s Home Energy Rebates Program. Please visit

How to Qualify for Tax Credits and Rebates on Home Battery Storage

Learn how to qualify for tax credits and rebates on your home battery storage system. This detailed guide breaks down federal, state, and utility-level incentives, making it

What are the new tax credit opportunities for energy storage

These new tax credit opportunities under the Inflation Reduction Act substantially enhance the financial incentives for deploying energy storage systems, both at residential and

Tax Guide for Green Technology

As California continues to be the national leader in green technology, the California Department of Tax and Fee Administration (CDTFA) understands the need to inform

Renewable Energy Equipment (TY2026 Property Tax Form)

This report is to provide information necessary for consideration in determining the full cash value of your renewable energy equipment property in Arizona for property tax

Clean Energy Tax Incentives for Businesses

Provides a tax deduction for the cost of energy eficiency improvements to commercial buildings, installed as part of the building envelope; interior lighting systems; or the heating, cooling,

How to Claim the Energy Storage Tax Credit

Navigate the federal tax credit for battery storage systems. Understand the key financial considerations and procedural steps to successfully claim this incentive.

Home Energy Upgrade Incentives | Governor''s Office of Resiliency

A tax credit for the purchase of residential clean energy equipment, including solar and geothermal electricity generation, solar water heaters, fuel cells, and battery storage.

Can You Qualify for the Home Battery Tax Credit?

Learn how to qualify for the home battery tax credit, calculate your claim, and properly document expenses to maximize potential savings on energy storage. Home battery

The State of Play for Energy Storage Tax Credits –

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

How to Qualify for Tax Credits and Rebates on Home Battery

Learn how to qualify for tax credits and rebates on your home battery storage system. This detailed guide breaks down federal, state, and utility-level incentives, making it

Page 1: Solar Tax Credits for Building-Related Energy Projects

On July 4, 2025, President Trump signed the OB3 Act into law. It makes significant changes to tax benefits pre-dating and modified by the Biden-era Inflation Reduction Act (IRA) for energy

Related information

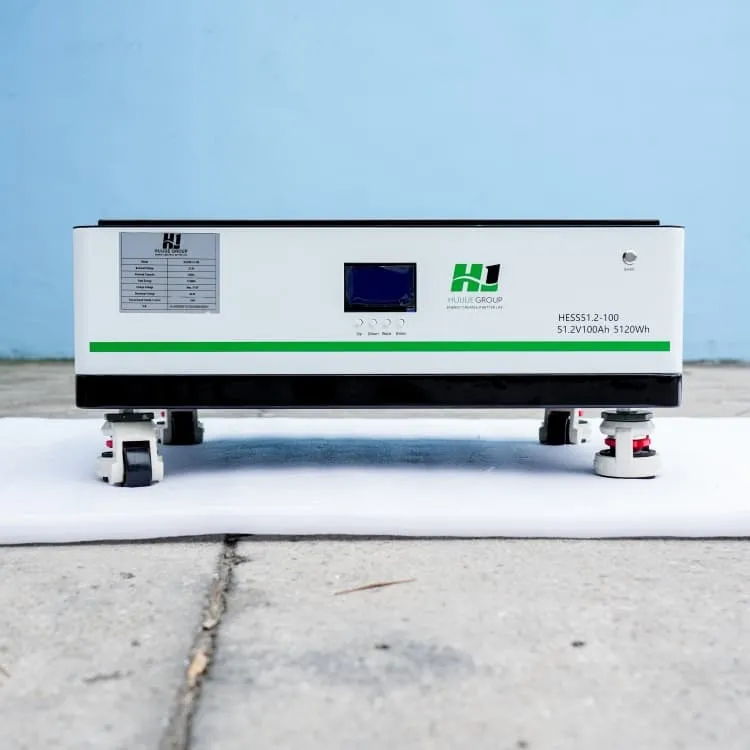

- Haiti Outdoor Energy Storage Power Supply

- 600W solar panels in summer

- Solar integrated chassis power supply system

- Djibouti communication base station battery room

- Cost of 8kw solar power generation system in Canada

- Oman power generation panels photovoltaic panels

- Imported photovoltaic grid-connected inverter

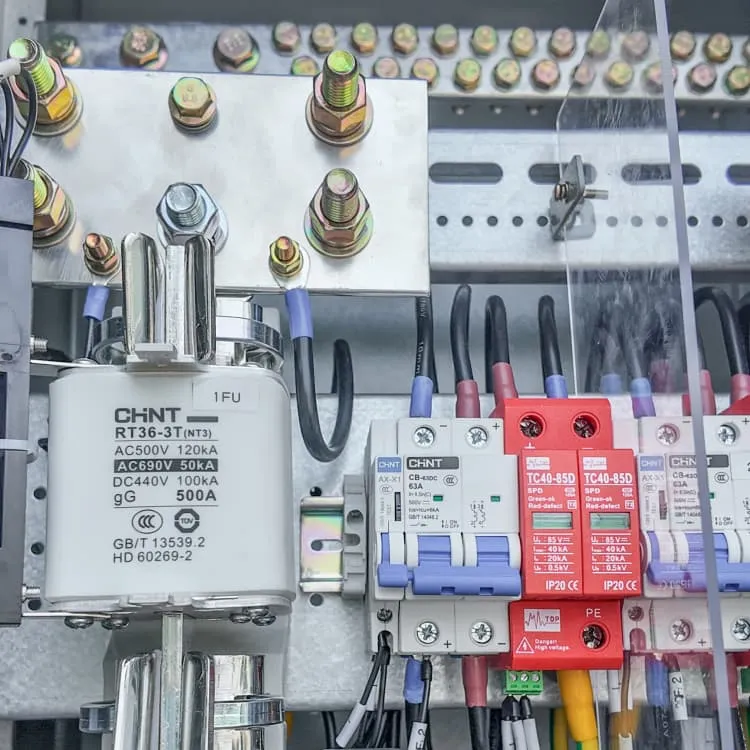

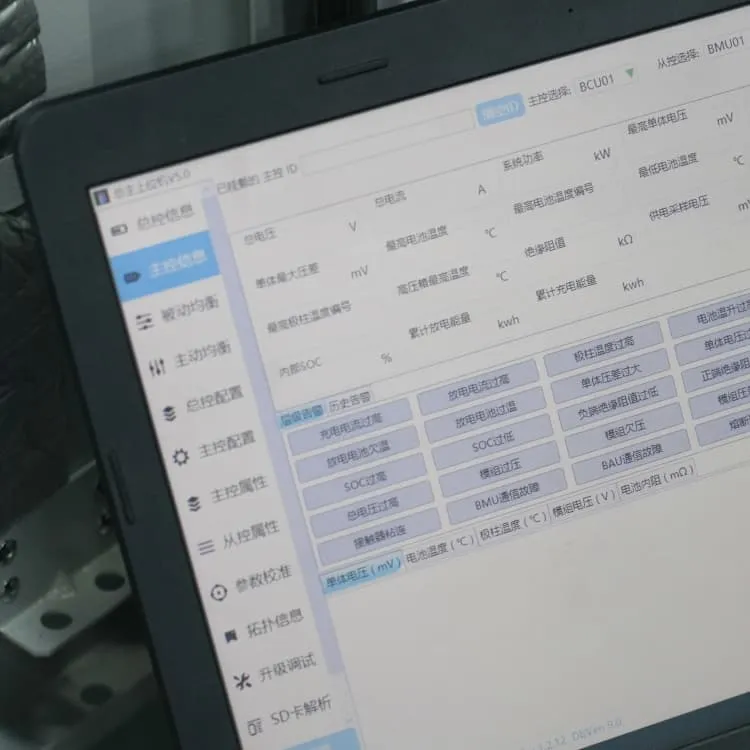

- 5G base station digital power supply

- Iodine liquid flow energy storage battery

- France produces energy storage containers

- Gambia outdoor energy storage power supply manufacturer

- Companies that make communication base stations

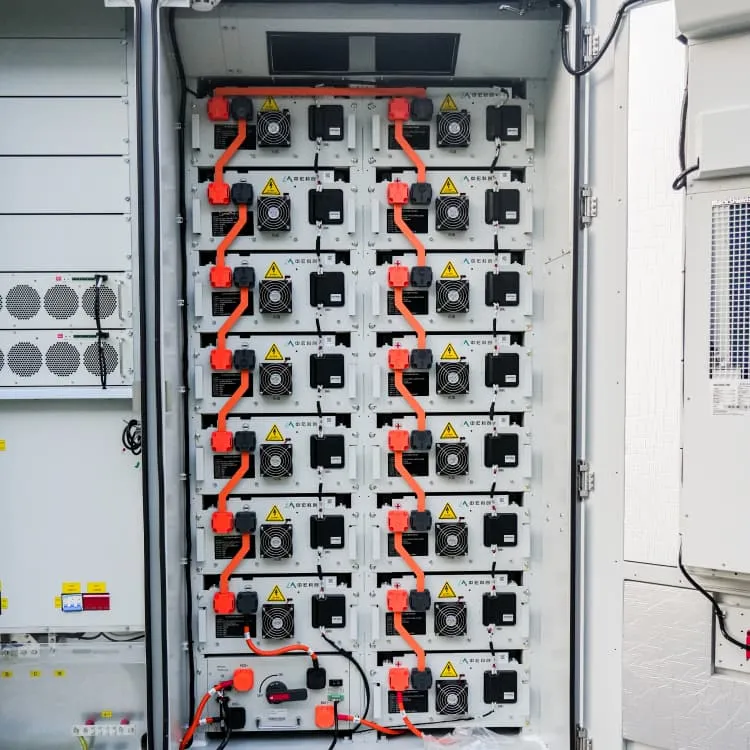

- Bangladesh DC Panel Battery Cabinet Company

- How many watts does a large solar panel have

- Which energy storage lithium battery OEM is the best

- Huawei Pumped Storage Photovoltaic Power Station Project

- Distributed Energy Storage in 2025

- Uruguay 100 square photovoltaic panel manufacturer

- Tunisia solar inverter

- Solar home waterproof home solar all-in-one machine

- Togo specializes in the production of energy storage cabinet batteries

- Communication base station energy storage system and its own energy storage cabinet

- Is bifacial photovoltaic panel power generation useful