Merchant Energy Storage Prices

Optimal scheduling for profit maximization of energy storage merchants

However, the trading decisions of large-scale energy storage merchants (e.g., pumped storage hydro) will affect the market prices. This paper employs dynamic

Energy Storage Pricing Insights

Energy Storage Pricing Insights Are you looking for instant access to pricing, availability, CapEx, and OpEx information to rapidly evaluate viable AC and DC integrated battery configurations

An update on merchant energy storage

Overall, as storage costs decline and merchant opportunities grow, investors will need to leverage advanced analytics to properly understand all storage value streams and options to mitigate risk.

Price Impact Assessment for Large-Scale Merchant Energy Storage Facilities

This paper analyzes the impact of an independently-operated large-scale energy storage system on the electricity prices of a fully competitive pool-based electricity market. From a

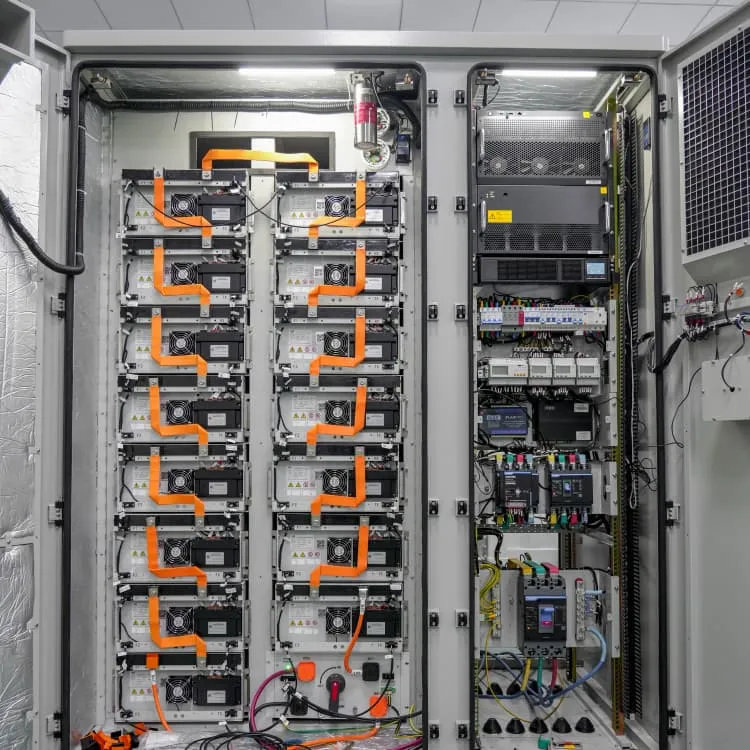

The Real Cost of Commercial Battery Energy Storage in 2025

Discover the true cost of commercial battery energy storage systems (ESS) in 2025. GSL Energy breaks down average prices, key cost factors, and why now is the best time for

7 Lessons learned from merchant energy storage projects

View current and forward-looking pricing provided directly from manufacturers and updated every month. Rank energy storage system options by total lifecycle cost, including CapEx, OpEx,

The Real Cost of Commercial Battery Energy Storage

But what will the real cost of commercial energy storage systems (ESS) be in 2025? Let''s analyze the numbers, the factors influencing them,

Unraveling the complexity of merchant energy storage projects

The energy source for these power plants is functionally limitless. [4] Storage projects buy and sell the same commodity (electricity) in the same market. Storage must therefore leverage intra

Sizing Merchant Energy Storage for Maximum Revenues

ABSTRACT As prices for energy storage (ES) decline, merchant-owned ES units have an opportunity to be profitable if they earn revenue from multiple streams. Most papers in the

Hedging Strategies to Optimize Merchant Energy Porfolio

To help develop optimal hedging strategies for renewable and storage assets, Ascend has identified four types of markets. The first type, exemplified by PJM or MISO, has

Economic dispatch for electricity merchant with energy storage

To mitigate the negative effect of the merchant''s market impact on buying and selling actions, the merchant may reduce the amount of generating or pumping electricity each

The evolution of the GB battery energy storage

Since September, the high wholesale volatility has supported frequency response prices in the battery energy storage revenue stack. This has come at a good

7 Lessons learned from merchant energy storage projects

This post will discuss considerations for evaluating merchant energy storage projects and offer suggestions to manage risks associated with the uncertainty of revenue

Ember: Merchant battery storage in India reaches 17% return in

Ember indicates that merchant battery storage in India is projected to achieve a potential 17% return in 2025, supported by falling costs and volatile electricity market prices.

Battery Energy Storage System Market Size, Trends & Regional

The global battery energy storage system market size was estimated at USD 10.16 billion in 2025 and is anticipated to grow from USD 12.61 billion in 2026 to USD 86.87 billion by 2034,

Price Impact Assessment for Large-Scale Merchant Energy

This paper analyzes the impact of an independently-operated large-scale energy stor-age system on the electricity prices of a fully competitive pool-based electricity market.

Energy Storage Pricing Insights

View current and forward-looking pricing provided directly from manufacturers and updated every month. Rank energy storage system options by total lifecycle cost, including CapEx, OpEx,

Sizing Merchant Energy Storage for Maximum Revenues

As prices for energy storage (ES) decline, merchant-owned ES units have an opportunity to be profitable if they earn revenue from multiple streams. Most papers in the literature provide a

Sizing Merchant Energy Storage for Maximum Revenues

In this paper, we present a flexible and comprehensive mathematical model to enable merchant-owned ES owners to maximize their profits by considering multiple revenue streams.

The Real Cost of Commercial Battery Energy Storage in 2025:

But what will the real cost of commercial energy storage systems (ESS) be in 2025? Let''s analyze the numbers, the factors influencing them, and why now is the best time

Price impact assessment for large-scale merchant energy storage

This paper analyzes the impact of an independently-operated large-scale energy storage system on the electricity prices of a fully competitive pool-ba

The Real Cost of Commercial Battery Energy Storage in 2025 | GSL Energy

Discover the true cost of commercial battery energy storage systems (ESS) in 2025. GSL Energy breaks down average prices, key cost factors, and why now is the best time for

Tolling agreements and floor pricing for BESS

This article explores tolling agreements and floor prices for battery systems in an interview with storage specialist Andras Molnar. For a complete overview of all revenue

5 FAQs about [Merchant Energy Storage Prices]

How risky is a merchant storage project?

Merchant storage projects are complex, but the risks can be measured and managed with appropriate planning and analysis. Merchant markets are evolving quickly all over the world, many being intentionally designed to incorporate more energy storage.

Is merchant storage difficult?

Merchant storage is complicated, but not impossible As the storage market evolves, we see projects with an increasing proportion of their revenue expected to come from the merchant market rather than firm contracts. Just a few years ago it was the opposite.

Will merchant storage investment opportunities become more attractive in the future?

asingly critical role in the future. Thus far, most storage developments have been utility-owned or backed by long-term contracts, but merchant storage investment opportunities may become more attractive as the markets evolve and investors become comfortable w th the value stacking opportunities.In 2019, CRA published an Insights1 on

Should paired merchant storage projects be compared to standalone storage?

The tradeoffs should be quantified when considering renewable paired merchant storage projects versus standalone storage. Batteries that are DC connected to solar charging facilities may have discharging limitations during periods of time when the solar is producing due to constraints of the shared inverter.

Is PJM a core merchant storage market?

ty in core merchant storage markets. PJM was a key focus market for early projects due to a combination of market access liberalization and h gh regulation pricing in the region. While ERCOT has seen limited action in storage thus far, it is clearly an emerging market given rece

Related information

- The role of wind power generation in power systems

- Units of measurement for energy storage batteries

- Power generation of photovoltaic panels installed flat

- Tunisian industrial energy storage cabinet supplier

- Thailand lithium iron phosphate battery pack

- How much does an energy storage container cost in Ireland

- Approximate cost of energy storage containers of local energy storage brands

- 12 watt solar system home cost

- Energy storage power conversion pcs price

- Wall-mounted solar panel 18 watts

- South Korean Communication Base Station Wind Power Construction Tender

- Malta Power Storage System Price

- How much electricity does a mobile outdoor power supply have

- Philippine lithium battery energy storage cabinet manufacturers ranking

- Price of home energy storage device

- 12 volt inverter cost

- Thailand outdoor energy storage

- Huawei Solar Photovoltaic Power Inverter

- Balkan Peninsula Energy Storage Container Power Station Construction

- Price of high-performance energy storage batteries in Ecuador

- 60v 20ah to 220v inverter

- Solar panels vs photovoltaic panels

- Solar panel depth