Public solar base station energy storage exemption

Frequently Asked Questions (FAQ) Construction of

A.B. 2143 defines a project for the "construction of any renewable electrical generation facility, and any associated battery storage, after December 31, 2023, that receives service pursuant to

Active Solar Energy System New Construction Exclusion:

Thus, the new construction exclusion applies to any active solar energy system new construction in process or completed before January 1, 2027, unless this date is further extended. After the

Identifying State-Focused Renewable Energy Tax Exemptions

Numerous states have either a solar or wind tax exemption, meaning that equipment used for electricity generation by either solar arrays or wind farms is exempt from

DOE Proposes Expanding NEPA Exemption for Solar, Batteries,

DOE proposes to establish a new categorical exclusion for certain energy storage systems and to revise existing categorical exclusions for upgrading and rebuilding

DOE Reduces Regulatory Hurdles For Energy Storage,

DOE is simplifying the environmental review process for certain energy storage systems such as battery systems, transmission line upgrades, and solar photovoltaic systems.

Pursuant to Public Act 233 of 2023

Nameplate capacities, measured in alternating current (AC), meet the following criteria: Solar facilities, including hybrid or co-located facilities comprised of solar and storage facilities,

Michigan Solar Property Tax Exemption Guide

Michigan''s commitment to renewable energy has led to significant incentives for solar power adoption, notably the property tax exemption. This policy encourages

What is the work of energy storage base station | NenPower

Moreover, energy storage base stations can stabilize the grid, reducing the risk of blackouts and ensuring a seamless energy supply. With the global shift towards sustainable

What is an energy storage base station? | NenPower

Energy storage base stations have emerged as pivotal components in modern energy systems. As the world confronts the challenges of energy transition, especially with a

Sales and Use Taxes: Exemptions and Exclusions

In general, California sales and use taxes are imposed on the retail sale or the use of tangible personal property in this state. Since the enactment of the Sales and Use Tax Law in 1933,

Leases and Easements for Energy Storage Projects Excluded

The new law clarifies that leases and easements for the financing, erection, and sale of energy storage projects are, like leases and easements for qualifying wind and solar

AB 1918: Solar-ready and photovoltaic and battery storage

Under this authority, the Energy Commission has established building standards for the installation of photovoltaic systems meeting certain requirements for certain residential

DOE''s Proposal to Exempt Solar, Storage, Transmission from

In November, 2023, the Department of Energy proposed to offer "categorical exclusions" from otherwise required environmental reviews for certain energy storage, solar

CESA Applauds Signing of Bipartisan Legislation Granting Energy Storage

CESA applauds the signing of AB 2625, granting energy storage zoning exemption in California, facilitating rapid deployment of clean energy technologies for grid resilience and

U.S. Department of Energy Issues Additional NEPA Exemptions for Solar

These exemptions would help certain solar energy projects avoid significant public disclosure and delay. On November 16, 2023, the U.S Department of Energy ("DOE") issued a

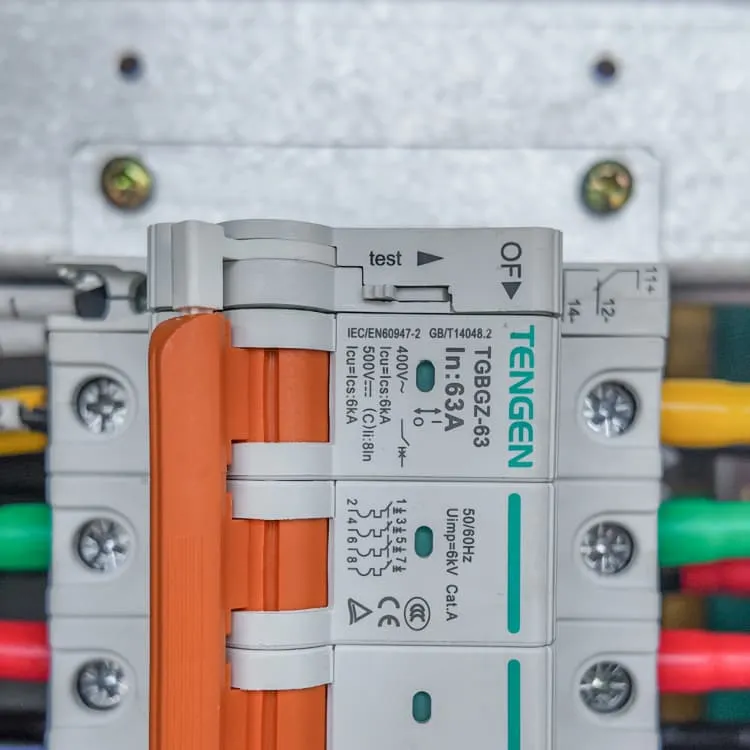

Battery Energy Storage Systems Series

An "active solar energy system" is a system that uses solar energy in the production of electricity and includes storage devices, power conditioning equipment, transfer equipment, and parts

Frequently Asked Questions (FAQ) Construction of

For information about NEM or NBT tariffs, please visit the website for the California Public Utilities Commission (CPUC), which developed the tariffs and is the state agency that oversees public

Public Utilities

As of May 1, 2021, purchases of utility scale battery energy storage systems by a public utility or a power subsidiary that sells or furnishes electricity are exempt from sales and use tax. A utility

Identifying State-Focused Renewable Energy Tax Exemptions

These exemptions would help certain solar energy projects avoid significant public disclosure and delay. On November 16, 2023, the U.S Department of Energy ("DOE") issued a

Adoption of Exemption for Trinity Public Utilities District''s Service

The proposed determination to exempt Trinity Public Utilities District service area from the 2025 Energy Code solar photovoltaic and battery energy storage system

SALT and Battery: Taxes on Energy Storage | Tax Notes

Typical exemptions or exclusions available for BESS vary by state and may be based on: if BESS co-locates with a solar or wind facility in a state that provides an exclusion

6 FAQs about [Public solar base station energy storage exemption]

Do energy storage systems qualify for a manufacturing exemption?

The Texas comptroller has published at least two private letter rulings explaining that energy storage systems do not qualify for the manufacturing exemption because the batteries are for storing the energy, and storage is not essential to generating the energy. 17

What exemptions and exclusions are available for Bess?

Typical exemptions or exclusions available for BESS vary by state and may be based on: if BESS co-locates with a solar or wind facility in a state that provides an exclusion or exemption for a solar or wind facility. Other issues facing BESS are the intended use of the facility and installation.

What if Bess co-locates with a solar or wind facility?

if BESS co-locates with a solar or wind facility in a state that provides an exclusion or exemption for a solar or wind facility. Other issues facing BESS are the intended use of the facility and installation. For instance, solar and wind facilities may be exempt or excluded from property tax.

Does Bess have a tax credit for solar?

Before the Inflation Reduction Act (IRA) was enacted in 2022, BESS could only access federal tax credit funding when powered by solar and required the business-owned storage to be charged with solar 75 percent of the time.

Is a stand-alone energy storage a qualified person?

Notably, no NAICS code describes stand-alone energy storage, and there is no published guidance on whether a stand-alone BESS could be a qualified person. Stand-alone BESS is subject to property tax. Texas offers an incentive program referred to as chapter 312 to attract new capital investment that has benefitted renewable development.

Does Bess have a sales tax exemption?

Florida law also provides manufacturing sales tax exemptions; however, these exemptions do not apply to the purchase of utility-scale BESS equipment used to store wind or solar power. Innovation is a driving force in the development and use of BESS.

Related information

- Photovoltaic energy storage integrated building

- The inverter has voltage instantly

- Huawei Armenia pack lithium battery

- Inverter charging battery

- Belarusian new energy battery storage

- Monaco photovoltaic panel supporting manufacturer

- Solar energy systems for rural households

- Albania inverter 33kw parameters

- The back temperature of double-glass modules in summer

- Construction of large-scale energy storage projects in Finland

- Is dual solar panel photovoltaic good

- Photovoltaic panel prices in Equatorial Guinea

- Where are the communication BESS power stations

- Solar Photovoltaics in Estonia

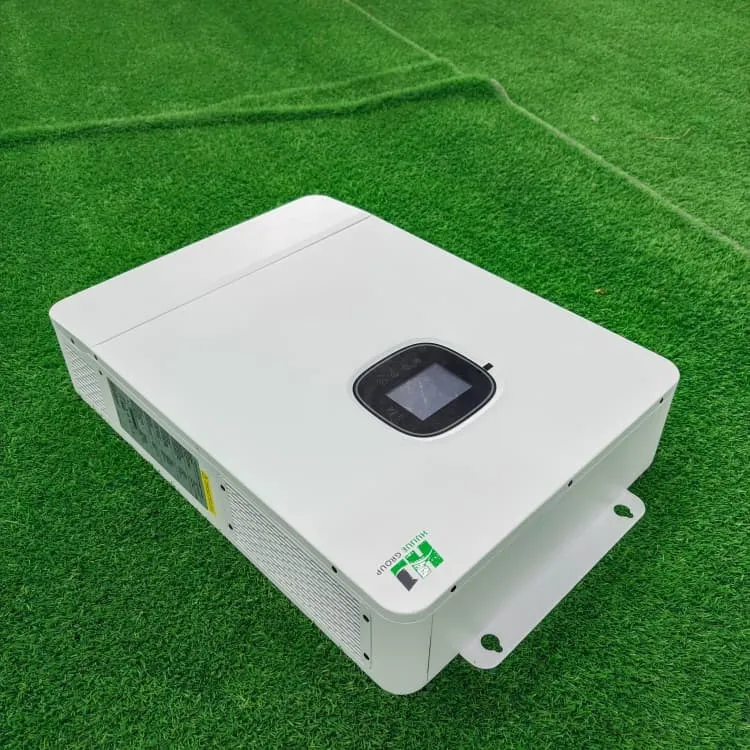

- Huijue Wind Solar and Energy Storage Project

- How much does North Korea s energy storage battery cost

- New Energy Storage Inverter Power Supply

- Solar 5V Water Pump Inverter

- Huijue 545 photovoltaic panel price

- Photovoltaic solar panels 620

- Indoor communication base station power supply installation

- Jordan photovoltaic power station inverter

- French low-carbon photovoltaic energy storage system